The entrepreneurial spirit thrives on innovation, often focusing on skills and services rather than physical products and storefronts. Yet, the challenge of securing startup capital remains a significant hurdle for these entrepreneurs.

Unlike traditional businesses with physical assets to offer as collateral, service-based ventures often face skepticism from lenders. This guide simplifies how service businesses can obtain essential loans by leveraging their strengths to fund their goals. With approximately 59% of small businesses applying for a loan in 2023 [Credit Suite, 2025], understanding the right financing avenues is paramount for success.

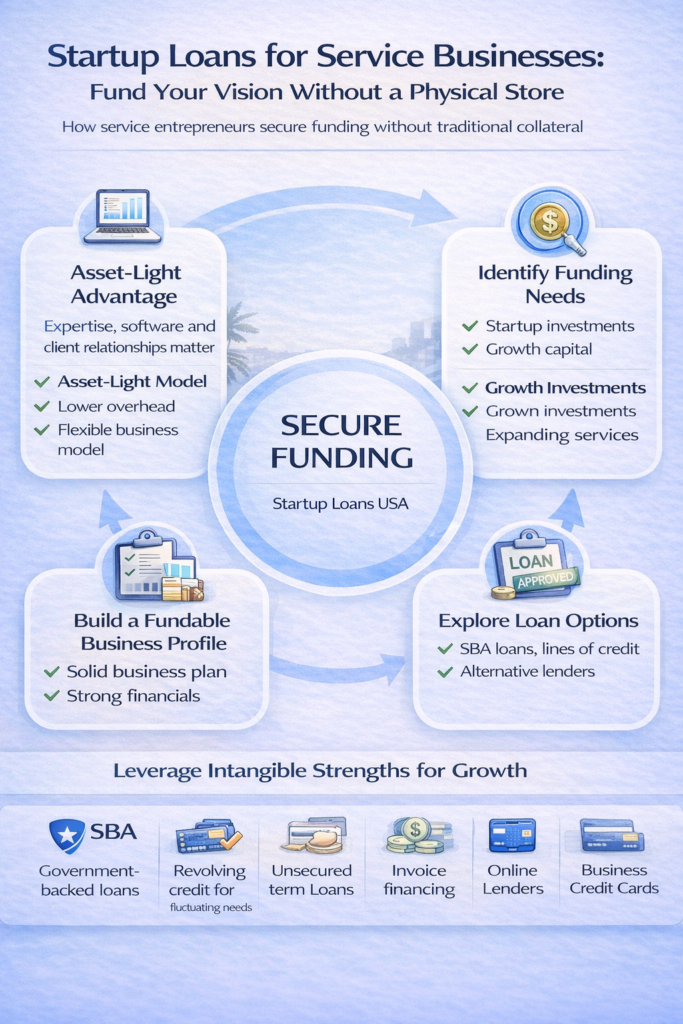

Service businesses, by their very nature, often operate with a lean infrastructure. This “asset-light” model presents both unique advantages and specific challenges when seeking funding.

An asset-light business model characterizes companies that require minimal physical assets to operate. For service providers—consultants, freelancers, digital agencies, coaches, software developers, and many others—their primary assets are intellectual property, expertise, client relationships, and human capital. This often leads to lower overhead costs, increased flexibility, and faster scaling of operations without the need to manage physical inventory or extensive real estate.

While a streamlined operational model is essential, access to capital remains critical for service-oriented businesses. Initial investments are necessary for essential tools like software, technology, professional development, marketing initiatives, and establishing a professional online presence. Moreover, securing initial clients and building a sustainable cash flow often requires upfront investment in sales efforts and operational readiness.

A common misconception is that business loans are primarily for purchasing physical equipment or property. However, lenders are increasingly recognizing the value and potential of service-based businesses. Funding can support intangible assets like brand development, marketing campaigns, advanced training, and technology upgrades that improve service delivery. The point is to demonstrate a clear path to revenue generation and profitability, regardless of physical collateral.

Before approaching lenders, a clear understanding of what your service business requires financially is essential. This foresight will guide your loan application and ensure you secure the right type and amount of funding.

For service businesses, startup costs are often concentrated in technology, marketing, and human capital. This includes subscriptions for specialized software, high-quality equipment, website development, marketing campaigns, legal fees, and professional training.

After the initial setup, securing capital becomes essential for growth and expansion. This may require hiring skilled staff, expanding services to meet demand, investing in training, or creating unique processes. The Business Services Market size is projected to reach USD 0.92 trillion by 2030, growing at a CAGR of 27.92% [Mordor Intelligence, 2025], indicating significant opportunities for growth that capital can fuel.

Working capital is the lifeblood of any business, and it’s particularly critical for service providers. Service businesses often experience a lag between delivering a service and receiving payment, creating a gap that working capital bridges. This funds daily operations, covers payroll, manages unexpected expenses, and enables the business to take on larger projects without cash flow issues. Having enough working capital is crucial for a startup’s success, as around 20% of them fail within their first two years [Oriel IPO, 2025].

Fortunately, a variety of funding options exist that are well-suited for service-based entrepreneurs, even without traditional collateral.

Small Business Administration (SBA) loans are government-backed loans offered through partner lenders. They often provide favorable terms, including lower interest rates and longer repayment periods. SBA loans have strict requirements but can offer significant funding for service businesses looking to start or expand.

A business line of credit provides entrepreneurs with a revolving source of funds to use as needed and repay over time. This is perfect for service businesses with inconsistent income or expenses, allowing for better management of cash flow and the ability to take advantage of immediate opportunities.

Unsecured business term loans do not require specific collateral. Lenders assess these loans based on the business’s creditworthiness, projected cash flow, and the entrepreneur’s financial history. Service businesses with strong revenue and good credit can use these loans for major investments.

For service businesses with outstanding invoices, invoice factoring and accounts receivable financing can provide immediate cash. A lender purchases your outstanding invoices at a discount, providing you with immediate funds. This leverages your existing accounts to generate working capital quickly.

Business credit cards can be a convenient source for short-term funding for smaller expenses. They offer quick access to funds, help build business credit, and often come with rewards programs. Responsible use is key to avoid high interest rates.

If business funding options are limited, entrepreneurs might consider personal loans. While these can provide essential funding, they also pose a risk to personal assets. It’s important to proceed carefully and have a clear repayment plan.

The rise of online lenders and alternative financing platforms has expanded access to capital for small businesses. These lenders provide faster applications, flexible eligibility, and quicker funding than traditional banks, making them ideal for service businesses needing quick access to funds. Lending from challenger and specialist banks has decreased slightly in 2023 but is still an important part of financing [money.co.uk, 2025].

Lenders assess risk. For service businesses, demonstrating your business’s viability and your capability as an entrepreneur is paramount.

A robust business plan is essential. It should clearly articulate your service offerings, target market, competitive advantages, marketing strategy, operational plan, and detailed financial projections. For service businesses, emphasize your expertise, client acquisition strategies, and revenue models.

Both your personal credit score and your business’s financial health are critical. Lenders will review your credit history, bank statements, and tax returns. Building a strong credit score, ideally above 700, significantly improves your chances of approval and securing favorable interest rates.

Ensure your business is legally established with all necessary licenses and permits. Clear contracts, well-defined service level agreements (SLAs), and transparent processes show professionalism and lower perceived risk for lenders.

To counter the lack of tangible collateral, focus on highlighting intangible strengths. Highlight strong client testimonials, successful case studies, a diverse client base, strategic partnerships, and a proven ability to deliver value. Robust customer service and high client retention rates are powerful indicators of business stability.

Navigating the loan application process requires preparation and attention to detail.

Prepare a complete package for the lender that includes your business plan, personal and business tax returns, bank statements, financial projections, and legal documents (licenses, registrations, client contracts). Also include any additional information the lender may request.

Different lenders specialize in different loan types and industries. Research lenders that have experience with service businesses and understand your specific sector. Compare interest rates, fees, repayment terms, and eligibility requirements.

Complete the application accurately and thoroughly. Once submitted, follow up professionally to inquire about the status and address any additional questions the lender may have. Patience is key, as the process can take time.

Before accepting any loan, carefully review all terms and conditions. Pay close attention to the interest rate, repayment schedule, any associated fees (origination fees, late fees), and prepayment penalties. Understanding these ensures you can manage the debt effectively.

While you may not have a physical store, lenders may consider other forms of collateral. This could include accounts receivable, valuable equipment (like specialized software licenses or high-end computers), or even personal guarantees. Clearly present any assets that could potentially serve as collateral.

Securing funding is only the first step; wisely deploying it is crucial for sustainable growth.

Use part of your loan for targeted marketing campaigns, digital ads, content creation, and networking events to attract new clients and grow your reach. This directly fuels revenue growth.

Funding your vision without a physical store is increasingly common in today’s economy. Service businesses can easily obtain capital through various loan options due to their flexibility and focus on expertise. Entrepreneurs can secure funding for their ventures by understanding their needs, creating a strong business profile, and effectively navigating the application process.

The small business lending market is projected to hit $7.22 trillion by 2032 [Canopy Servicing, 2025], highlighting the ongoing need for innovative financing options. Show your business’s potential, manage finances well, and use your asset-light advantages to secure funding for your vision.

Subscribe for our monthly newsletter to stay updated.

Open collections can impact your startup loan approval, but they don’t automatically disqualify you. Learn how lenders evaluate credit history, what matters most, and how to strengthen your application for business financing.

How long after credit damage can you qualify for a startup loan? While late payments, collections, or bankruptcy can impact approval, lenders focus on recovery trends, financial stability, and recent payment behavior. Learn how long different types of credit damage affect your eligibility and what steps you can take to improve your chances of securing startup funding faster.

Taking recent unsecured loans before applying for a startup loan may reduce approval odds, increase interest rates, and lower funding amounts. Learn how credit score impact, debt-to-income ratio, and timing affect your ability to secure business financing.